Financial controls are an essential process, especially in ensuring transparency and minimizing risks, and generally in managing finances appropriately within a firm. Although majority of individuals refer to such controls as focusing on listed companies, they are also vital to implement in the unlisted companies. With increased regulation on the business, it is becoming important to know the internal financial controls applicability company and its framework to remain compliant with the regulation and to protect the firm.

What Are Internal Financial Controls?

Internal financial controls refer to systems and processes implemented in the company to ascertain that the financial processes of the company are running right. The controls are useful in identifying and avoiding frauds, mistakes, and inaccuracies. They include such issues as the authorization of the transactions, keeping of the records correct and proper way of preserving assets and obeying laws and regulations.

In case of unlisted companies, particularly in case of private limited firms or close firms, these controls provide a structured way to manage finances and build investor confidence.

Applicability for Unlisted Companies

The Companies Act, 2013 in India mandates all the companies to have the internal financial controls, not necessarily listed companies alone. Section 134(5) (e) and Section 143(3) (i) of the Act states that though unlisted companies, they must ensure establishment of adequate internal financial controls as well as maintain their effective functioning.

Thus, knowledge of the internal financial controls applicability company frameworks is not a decision, but a law. The auditor also must express the opinion on the adequacy and operating effectiveness of these controls in the auditor’s report.

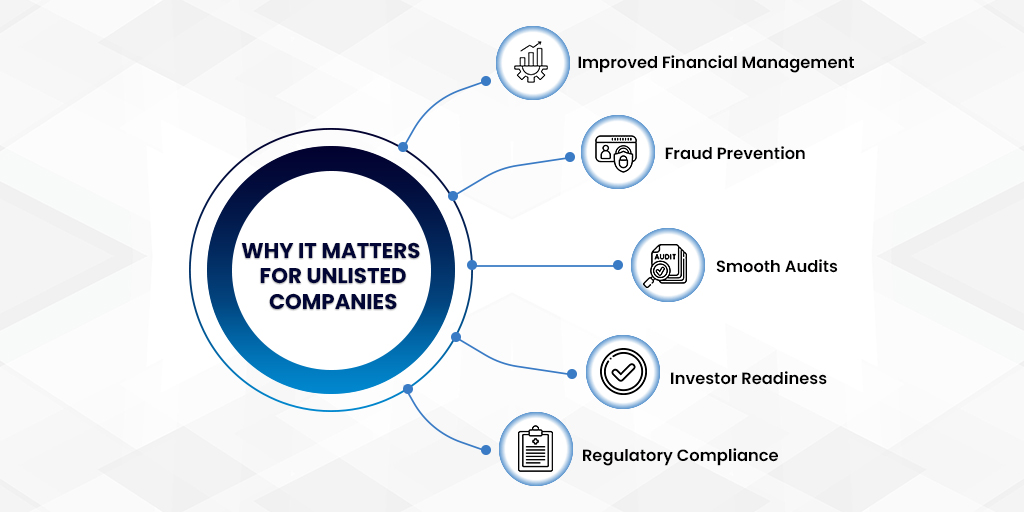

Why It Matters for Unlisted Companies

Although the unlisted companies might not be answerable to public shareholders, they still hold accountability in terms of maintaining good governance; more so when they plan to raise funds, attract investors, or eventually go public.

Here’s why it matters:

- Improved Financial Management: With improved internal controls put into place, companies can ensure the credibility in relation to their financial records. This also enables those informed decisions are executed and the chances of financial misstatements are reduced.

- Fraud Prevention: One of the major benefits of understanding internal financial controls applicability company obligations is to prevent misuse of funds. It becomes easier to track unusual transactions or behavior early.

- Smooth Audits: Auditors are required to check whether adequate internal financial controls exist. If controls are missing or deemed to be weak, it can result in negative audit remarks. This could affect investor confidence and business reputation.

- Investor Readiness: Investors prefer companies that follow basic financial discipline. If an unlisted company shows it has strong internal controls, it becomes more attractive to banks, lenders, and venture capitalists.

- Regulatory Compliance: By fulfilling the internal financial controls applicability company standards, firms reduce the risk of penalties and legal action due to non-compliance.

Key Areas to Focus On

Unlisted companies should begin by reviewing the following areas:

- Approval processes for payments and purchases

- Clear roles and responsibilities of employees handling finance

- Regular reconciliation of bank statements

- Proper documentation and filing of financial data

- Timely internal reviews and checks

If these areas are managed properly, the company can meet compliance standards and improve day-to-day financial efficiency.

How to Implement

Many unlisted companies worry about cost and complexity in implementing IFC. However, a structured yet simple approach can be highly effective:

- Start Small: Introduce clear approval and reporting systems.

- Use Technology: Basic accounting software can streamline controls.

- Conduct Regular Checks: Periodic reviews help detect gaps early.

- Seek Expert Help: External consultants can design tailored IFC frameworks suited to the company’s size and industry.